Gold and silver took a beating on Friday. After gapping lower at the open, the precious metals ended the day down -1.43% and -1.97%, respectively. These declines are just the latest in a series of setbacks that have struck the metals over the last few weeks, as both gold and silver are now respectively -5% and -8% below their year-to-date highs reached in mid January. This recently poor performance has been gut wrenching for those that are long the metals, particularly in an environment where the stock market seemingly cannot trade lower for 30 minutes in any given trading day without being prodded back higher. So following this latest setback on Friday, it is reasonable to raise a critical question about gold and silver. Is it time to relent on these positions, or should conviction be maintained?

Time horizon is the first important point that must be examined when answering this question. Put simply, precious metals are not well suited for those investors with a short-term time horizon. This is due to the fact that gold and silver prices are highly volatile and can experience wide swings over short-term periods of time. And Friday was no exception in this regard. Other than those market participants that are experts in trading the metals, investors that own gold and silver are better served to view these allocations with a long-term time horizon in mind.

Those owning gold and silver as a long-term investment typically have a fundamental thesis for owning these metals. Such views may include but are not limited to the following: hard asset protection against competitive currency devaluations and inflation, a safe haven in a possible crisis scenario, an alternative reserve currency that is protected from being debased by policy actions and potential industrial demand in the case of silver.

This, of course, leads to the next logical question. If you own gold and silver as an investment, did anything specifically happen on Friday that fundamentally changed any of the underlying reasons for owning both gold and silver? The answer here is plainly no. While some cited rhetoric leading up to the G20 meeting against central banks that are aggressively debasing their currencies as a reason for the decline, this is a most obtuse reason if it is indeed the cause. After all, does anyone really think that the extraordinarily aggressive monetary policy actions by central banks from around the world will be curbed in any way by some passing comments at the G20 meeting? Sure, we'll get the customary statements about monetary responsibility and the desire for sound currencies, and then everyone will go back home to kick the printing presses back on at full power. If anything, the magnitude of the decline on Friday was far more likely due to a recent void in demand from China due to their New Year holiday coupled with thin trading volume in the U.S. ahead of the holiday weekend.

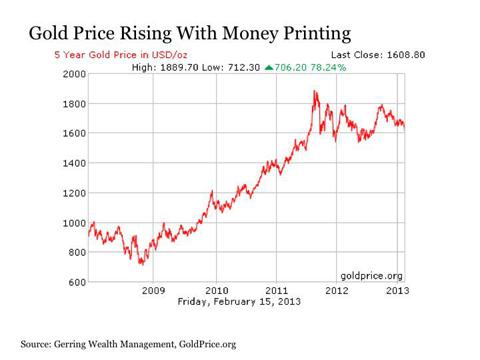

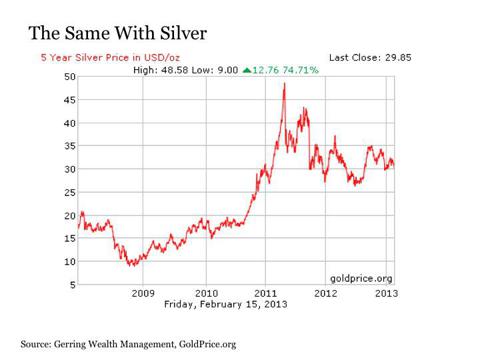

One important and simple fact continues to robustly support the investment thesis for continuing to own both gold and silver as an investment despite the recent volatility. As long as global central banks are rampantly printing money, the longer-term influences on gold and silver will remain meaningfully to the upside. Here's why.

Money derives its value in part through its scarcity. In other words, if a currency such as the U.S. dollar is demanded but is in limited supply, the more it will be coveted once it is obtained and the greater its purchasing power will be as a result. Conversely, if the supply of U.S. dollars becomes increasingly plentiful, the currency will become less desirable and its purchasing power will be diminished. The U.S. Federal Reserve is responsible for managing this supply of U.S. dollars, and their actions in this regard has been unprecedented in recent years. The Fed has already quadrupled the supply of dollars in the financial system to $3 trillion over the last four years alone. And they are set to print another $1 trillion U.S. dollars over the coming year. The Fed is certainly not alone in this regard, as major central banks from around the world have been printing money with wild abandon in recent years. And their ability to print ever more fiat currencies going forward is effectively boundless.

Gold and silver have distinctly different characteristics versus fiat currencies. While the supply of U.S. dollars available in the global financial system is determined by the whims of the U.S. Federal Reserve, such is not the case for the precious metals. The supply of both gold and silver is finite. Only so much of each metal exists on the planet and they certainly cannot be printed out of thin air the way that fiat currencies can. In short, we have fiat currencies that are potentially in infinite supply that are exchanged for precious metals that effectively serve as alternative currencies that are in finite supply.

These characteristics lead to the following. The scarcity of global fiat currencies is increasingly diminished as each new paper note is printed, which results in an erosion in the purchasing power of the currencies in acquiring goods and services. And since the supply of gold and silver is not only finite but relatively fixed, the cost in fiat currencies to acquire these metals is likely to increasingly rise over the long-term with global central banks remaining intent on printing ever more quantities of money. This includes the Fed and the $1 trillion plus of additional U.S. currency supply that is set to flow into the financial system in the coming months. Thus the store of value appeal for both gold and silver and the long-term upward pressure on the prices for these metals as a result.

(click to enlarge)

(click to enlarge)

Awaiting the Real Great Rotation

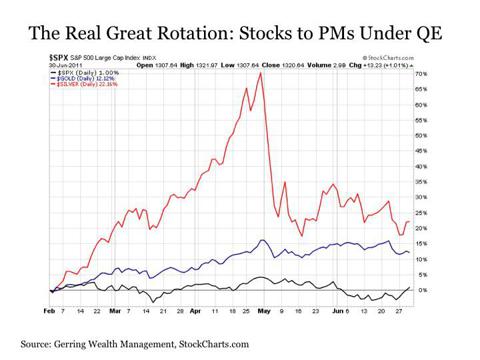

So why then have we seen such lackluster results from gold and silver thus far under the Fed's latest QE3 stimulus program? This is due to the fact that gold and silver typically have not led when a new QE stimulus plan is launched. Instead, stocks have been the first to move higher. But after a couple of months, the capital that was initially flowing into stocks has rotated into the precious metals. This is a key potential development to watch for in the days and weeks ahead.

Before going any further, it is important to note that the key for any sustained asset price inflation under QE has been Treasury purchases. So while the current QE3 program was initially launched in September 2012, the melt up in asset prices did not commence until Treasury purchases began with the New Year in January 2013.

When reflecting on past QE programs once Treasury purchases were initiated, a similar outcome was seen. When Treasury purchases were added to QE1 in mid March 2009, the stock market immediately pushed to the upside. But gold and silver were lower more than a month later. It was only after stocks reached their first peak and corrected in June 2009 that gold and silver finally exploded to the upside.

This phenomenon was even more pronounced during QE2. Stocks moved to the upside first when QE2 took hold at the end of November 2010. But it wasn't until stocks peaked just over two months later in February 2011 that gold and silver moved off the sidelines and erupted higher. And these precious metals outperformed dramatically while stocks languished for the remainder of the program.

(click to enlarge)

If and when we see this rotation from stocks to precious metals under QE3 remains to be seen. One disadvantage that stocks have in the current episode is the fact that key fundamentals including global economic growth and corporate earnings are increasingly deteriorating in an environment where the outlook remains far too optimistic. Another is that the magnitude of Treasury purchases at $45 billion per month is roughly half of what it was under QE2. Also, fiscal stimulus that provided an added lift to stock prices during past QE programs are all but finished today with the drags of higher taxes and the likelihood of reduced government spending in its place. Thus, it is possible that we may see stocks peak sooner under QE3 than witnessed in the past, as stocks will be increasingly hard pressed to continue pushing higher following their already strong year-to-date advance. However, with new money flowing freely from the Fed, another 50-70 points if not more to the upside on the S&P 500 over the next month if not longer is certainly possible before stocks finally top out. But once this rotation begins, the potential upside for gold and silver remains meaningful, particularly given how much both metals already lagged stocks leading into the current QE program.

So while it has been a tough road for both gold and silver thus far under QE3 including Friday's abysmal performance, the core basic fundamentals continue to support a long-term move higher in both precious metals in the coming months. And if we see another rotation in QE derived capital flows from stocks into gold and silver, the final rewards could prove substantial. The key remains surviving the gut check along the way in getting there. In terms of establishing portfolio allocations, the Central GoldTrust (GTU), the Central Fund of Canada (CEF) and the Sprott Physical Silver Trust (PSLV) are all ideal selections.

This post is for information purposes only. There are risks involved with investing including loss of principal. Gerring Wealth Management (GWM) makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by GWM. There is no guarantee that the goals of the strategies discussed by GWM will be met.

Disclosure: I am long CEF, GTU, PSLV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long the U.S. stock market via the MDY and SPLV as well as selected individual stock positions.

Source: http://seekingalpha.com/article/1199661-it-s-gut-check-time-for-gold-and-silver

my fair lady conversion disorder the chronicle spinal stenosis the forgotten man mike jones just friends

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.